Walk into a bottleshop owned by one of the country's major retailers and the shelves are likely to be stocked with more craft beer than ever before. But it's not just offerings from indie brewers or the homegrown and acquired craft brands of the big brewers filling the shelves and fridges – the range of beers brewed exclusively for the supermarket chains has been growing steadily too.

Craft beer brewed for supermarkets isn’t new – indeed, Gage Roads was a quarter-owned by Woolworths until 2016 and our Ownership Infographics have featured the likes of Sail & Anchor, Steamrail, John Boston, 3 Pub Circus, and more over the years.

But it's an area of their business upon which Coles and the Endeavour Drinks Group – now de-merged from Woolworths but still owner of the ALH Group of 300-plus venues, Dan Murphy's, BWS and Jimmy Brings – have been training ever greater focus.

Coles Liquor has been pushing the Tinnies range, which has been collecting trophies along the way, alongside longstanding brands like Lorry Boys. Within Endeavour, the Pinnacle Drinks range includes a rapidly-expanding lineup of craft beer brands.

Joining Pinnacle's craftier offerings over the past couple of years have been Culture House (sours), Zytho Brewing, Initial Brewing, Colossal Brewing, Algorithm Brewing, Gogo Fish and, most recently, Crony. While there have been a couple of stouts released under the Zytho label, for the most part the brands are home to hop forward beers – pales and IPAs typically of a traditional American leaning – although Gogo Fish comes with a quirkier hop selection.

There's even the fundraising Hughie Beer, which raises money for farmers through GIVIT, and Stubbie, both of which sit closer to Coles' expansive Smithy's range of more traditional, throwback Aussie beers aimed at more mainstream drinkers. Endeavour have recently started promoting a lineup of imported lagers available exclusively through their stores too.

It's a pretty broad selection, with the new arrivals of the past couple of years coming in cans designed so they wouldn't look out of place in the fridges of an independent retailer. Certainly, there's more "homebrand" beers on shelves now than most of the brewery owners we've spoken to realised, and we've seen some pretty sharp pricing too: on a recent visit to a local Liquorland, Lorry Boys Pacific Ale was going for $10 a four-pack; Dan Murphy's members were able to snap up two cases of Stubbie for $76 not long ago.

At a time when both Coles Liquor and Endeavour have been pushing their support for small, local and indie brewers – see last year’s Local Luvva campaign from BWS, the new South Melbourne Dan Murphy’s (pictured above) which ranges around 450 cold beers of which around a third are Victorian, or the way Coles have been reworking many of their First Choice stores – it raises some interesting questions.

How does a greater focus on developing and promoting their own brands fit with supporting local? While these lines of typically very well made, approachable – and, in some cases, trophy-winning – beers puts money in the pockets of their partner brewers, such as Tribe, Brick Lane and Gage Roads, do they make it harder for other independents to cut through and compete? Or are such brands merely another piece in the ever more complex puzzle that is craft beer today?

Looking at it more broadly, like a can of tomatoes or a box of cereal produced under license, are they homebrand craft, gateway beers, or something else? While the small print on their labels states they're brewed or "crafted" for Pinnacle Drinks or Liquorland, for example, are consumers actually looking that closely? If they are, do they know what Pinnacle Drinks means in terms of where their dollars are going? And, if so, do they care?

Diarmaid O’Mordha is group quality assurance and sustainability manager at Endeavour, who we've previously spoken to for this story on beer quality. Before taking on his current role, Diarmaid oversaw quality at Pinnacle Drinks for close to four years, and says comparing the Pinnacle he was directly involved in to today's version, particularly in regard to craft, is chalk and cheese.

“I’m a bit jealous actually of the beers they’re now knocking out,” he says, pointing to the size of the range under the one banner.

“The evolution of Pinnacle has been quite amazing. Today, you could actually section off Pinnacle, pick it up, and it would be a major competitor to other suppliers.”

As for why they create and develop their own brands, Diarmaid says the process of having more control over each level of the supply chain "helps to deliver better margins", adding: “If you’re actually in control of the supply further down, then you can get better return on your costs.”

When we spoke, the group’s biggest sellers were those that more closely resemble beer from the world’s largest beer companies: the top three were Hollandia, Steersman and TUN. For those that more closely resemble craft brands, John Boston was the group’s largest by volume, although the Tribe-brewed Zytho range is on track to take its mantle.

Diarmaid believes the growth of Pinnacle’s own craft brands reflects the group’s wider embrace of the craft beer industry and the inclusion of more local breweries within its network of stores.

“[Craft is] a category to us that’s had amazing growth trajectory and has been a great success for our business as a whole,” he says, claiming they see no risk that stocking a wide range of their own brands comes at the expense of those from external suppliers.

“It has to be done from a position where we’re there to support it and gain share in an area that’s not taking away from other suppliers we’re working with,” he says, describing the Pinnacle range as appealing more to people who are price-conscious or looking for more entry-level craft brands.

“We don’t play in that high-end category at all – you’re not going to be paying $15 a can for any of our products,” he says.

Paul Bowker, managing director at Brick Lane, which brews the Tinnies range for Coles, believes it’s natural for large retailers to look for better margins through vertical integration.

“It shouldn’t be a surprise to anyone that it’s an area of growth that both Coles and Endeavour have identified,” he says. “Particularly over the last couple of years, it looks like it’s accelerating considerably.”

At Brick Lane, they make a substantial amount of beer for others – not just Tinnies but other brands for drinks businesses large and small – with close to a third of their output currently their own beers.

As a business at which brewing for others is built into their model, Brick Lane arguably benefits from the increase in private label beer. That said, Paul believes there are benefits for the wider beer industry, including independents, that comes from the increased care and attention Coles and Endeavour are paying to the craft beer market. He points to the fact that together they supply around 70 percent of alcoholic drinks to Aussie consumers, so, if the supermarket chains do craft styles well, it might attract more drinkers to explore further.

“If the consumer is having a very good experience with a particular beer, then they’re more likely to shop wider within that category and then to adjacent categories to try other beers. Hopefully, one feeds the other and that’s an ideal outcome for beer as a whole.”

As for the impact of "supermarket brands" on beers from brewing companies, Paul says it depends on a brewery’s wider strategy. For some, their focus is on selling their own beer directly, whether through their own venue or direct online retail.

“Within local and regional, there’s huge opportunity and huge growth still," he says, "and the impact of national retailers with their own brands shouldn’t really impact those businesses and their future.”

Where the impact is more likely to be felt, he believes, is at the bigger breweries with national reach, or those with ambitions to sell their beer nationally through the major retailers.

“If that ranging is fundamental to your business model then that means you are competing pretty hard with the supermarket-owned brands that are usually national as well,” he says.

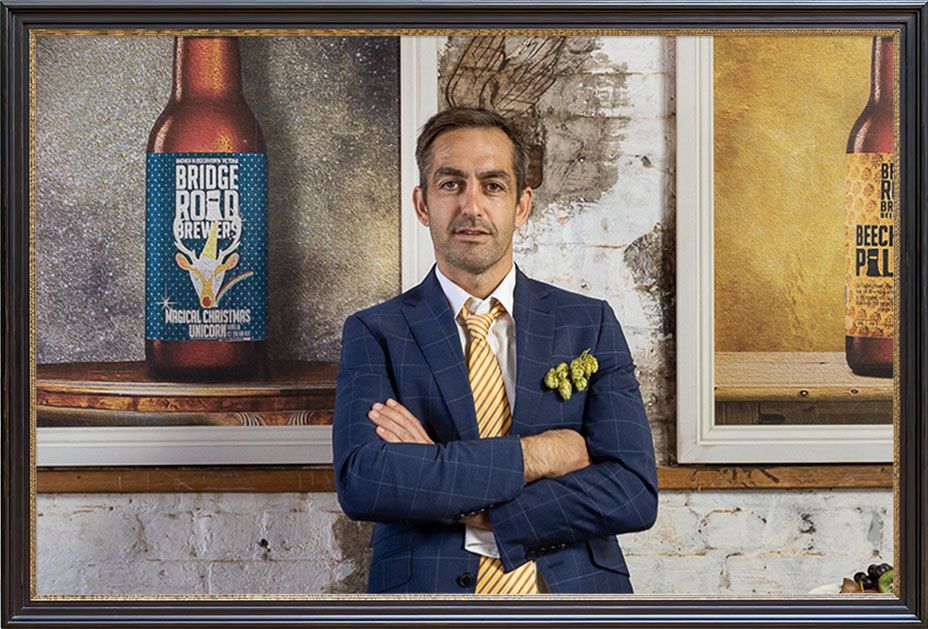

One independent brewer who's been working with Dan Murphy’s longer, and in a more involved manner, than most of his peers is Ben Kraus. The founder of the fiercely independent, family-owned Bridge Road Brewers, says they're now working with Coles Liquor more than at any time in the past too.

Over the years, they have created versions of the Bridge Road Advent Calendar in partnership with Dan Murphy’s and, while the brewery has a long pedigree when it comes to working with independent retailers on exclusive releases, Ben says they can’t match the reach and audience offered by the majors.

Looking at the growing range of private label beers, he suggests the focus in this area is driven more by dealings with the country's biggest brewers than the independent sector whose beers their craftier ranges ape.

“One can only assume that it’s about continuing to apply pressure to those major suppliers – to have the upper hand dealing with the two major brewers,” he says of the decision to work with the likes of Tribe, Gage Roads and Brick Lane. “Otherwise they’d get CUB to make these beers for them.

“By generating competition, it puts them in a stronger position. Maybe us little guys are collateral damage.”

What’s more, Ben says that – for now at least – indie brewers aren’t being forced to drop their prices in dealings with Endeavour or Coles in the manner they once did.

“They’ve talked about maintaining margins and keeping that category at a higher value,” he says. “It doesn’t mean independent brewers are making a bigger margin, it just means you don’t have to discount. There’s no pressure to compete on price – they give us a price with a margin to survive on and they get a margin they need.”

He suggests that what price pressures there are for smaller brewers are coming from within the independent sector itself. Ben cites Gage Roads, Brick Lane and Moon Dog as examples of brewing companies operating on a scale that allows them to produce cases of 24 full strength, 375ml craft beers that retail for less than $60.

“That’s not attainable [without substantial scale], but small brewers might feel pressure to join in,” he says. “I’m sure consumers appreciate it, but long-term for the industry it’s quite damaging.”

When it comes to transparency in terms of ownership, Diarmaid says they make it clear which beers are made for Pinnacle and doesn’t think it impacts the work they do with local breweries.

“All our products clearly say they’re produced for Pinnacle Drinks," he says. "We don’t hide that, and put all our contact details on it.”

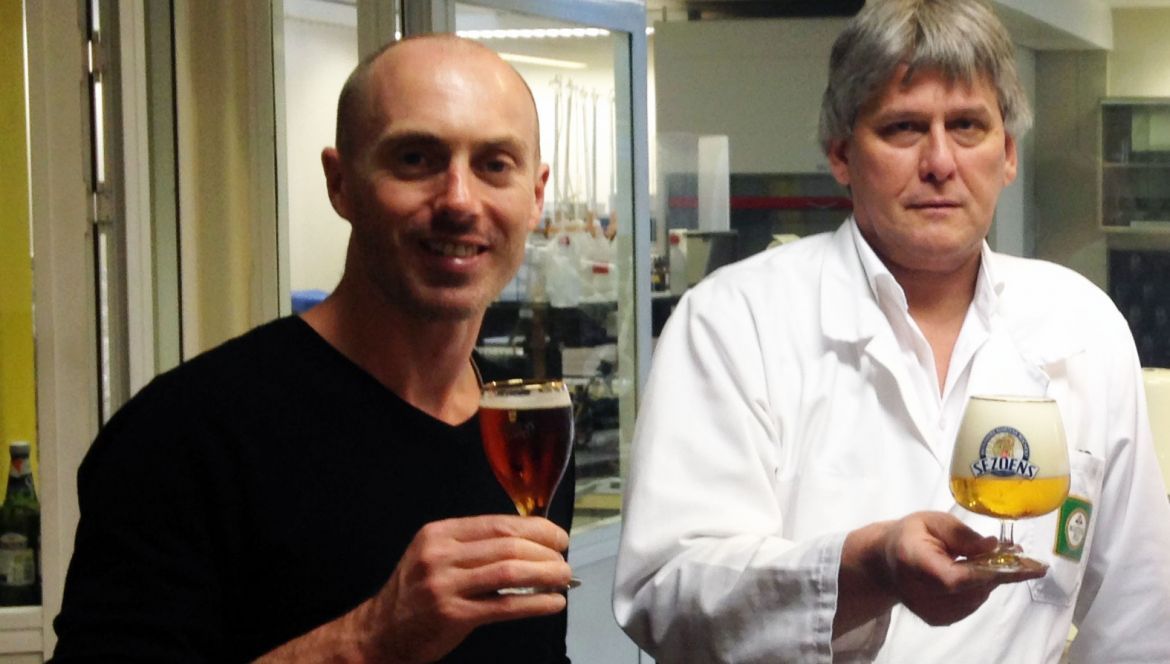

Kylie Lethbridge, CEO of the IBA (pictured below), which devised the independence seal used by many of its member brewers, says the association is always working with the major retailers to help increase the profile of its members.

“The heroes in this story I think are consumers who are clearly driving the change in this space with an increased focus and desire to ‘buy local’,” she says.

“The wider market is responding to that by offering more choice, and stocking these sorts of products.

“There are still so many people that still don’t know about pale ales, or stouts, and seeing these beers displayed prominently on shelves is nothing but a great thing for the entire industry."

Indeed, you don't have to step too far outside the craft beer bubble to realise how far the industry still has to go to raise awareness of the choice on offer these days, let alone convince drinkers for whom a regional BWS or Liquorland is their main touchpoint with craft beer to try an IPA or sour – and that's without broaching the subject of ownership.

As Ben and his team at Bridge Road Brewers discovered when conducting a spot of market research, in one group not a single person said independence mattered to them when it came to their purchasing decisions.

“It’s an interesting conundrum,” he says. “How well are people identifying independent beer anyway?”

And, with a growing number of craft style beers now part of the two biggest booze retailers' offerings, it's a conundrum that isn't getting any simpler.

So, over to our readers, how well are you identifying independent beer? Were you aware there were so many "homebrand" craft beers in the fridges of the country's biggest retailers? And, if they taste good and are well priced, do you care?

You can find other articles in our Big Issue series here. You can find past articles on the issue of ownership here.